- Save article

News

NewsBT Pension Scheme completes two longevity swaps totalling £10bn

The arrangements cover BTPS pensioner liabilities of £5bn with Swiss Re and increase existing cover with RGA by £5bn

- Save articleNews

Alecta invests $250m in natural catastrophe risk via Swiss Re platform

Sweden’s largest pension fund says asset is highly diversifying and still produces attractive return over time

- Save article

News

NewsGovernments told to spell out investors’ role in climate adaptation plans

Chamber of Commerce paper comes as Commission launches call for evidence on climate resilience

- Save article

News

NewsPensionsEurope elects new chair

Jacques Van Dijken will serve until at least November, when PensionsEurope’s next general assembly is held

- Save article

Features

FeaturesInsurance-linked securities bank a stellar year for returns

Insurance-linked securities (ILS) may be complicated, but they are gaining an institutional following especially among pension and sovereign wealth funds, multi-asset investment firms and endowments.

- Save article

News

NewsPeople moves: Denmark’s Velliv Foreningen picks new chief

Plus: People’s Partnership appoints first social purpose and sustainable business director; Sarasin & Partners names head of investment

- Save article

Analysis

AnalysisIPE UK Briefing: Government’s growth ambition for the UK

Plus: LGPS consolidation plans; Longevity swaps

- Save articleNews

Insurers, banks natural partners in long-term financing – Swiss Re

Former ECB head Trichet calls on institutions to ‘bias equities’

- Save articleNews

Credit Suisse, Swiss Re launch DC vehicle in Netherlands

i-PensionSolutions to be first ‘truly open-architecture’ PPI, parties say

- Save article

News

NewsBaillie Gifford ditches climate collaborations over ‘contested membership’

‘Our membership has become contested, and this risks distracting from our core responsibilities,’ the firm says

- Save article

News

NewsEthos rates Swiss listed companies’ sustainability reports as ‘poor’

Companies are bound to fail to design credible and ambitious environmental and climate strategies to meet climate targets, says foundation

- Save article

Special Report

Special ReportNet-zero goals in a post-COP30 world

The goals of the Paris Agreement are looking increasingly unachievable, leaving asset owners with a dilemma, writes Sophie Robinson-Tillett

- Save articleFeatures

Insurance-linked securities wind brings good news for investors

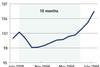

In the two decades prior to 2022, the negative correlation between stock and treasury bond market returns has been a key driver of institutional investor portfolio construction. Fixed income allocations provided investors significant relief during equity market downturns and increased expected risk-adjusted returns for the popular 60/40 stock/bond portfolio.

- Save article

News

NewsPeople moves: NEST creates chief technology, operating officer role

NEST, M&G Investments, ASIP, Fondaereo, Fondo Pensione Byblos, La Française, Axyon AI, Alter Domus, Stafford

- Save article

News

NewsSwiss Re report highlights growing risk of natural catastrophes

GLOBAL – Natural catastrophes, man-made disasters cause economic losses of $186bn in 2012.

- Save article

News

NewsESG roundup: Actuarial Profession, Swiss Re, Sustainability Yearbook

GLOBAL – Actuaries must incorporate resource constraints into models, Actuarial Profession says.

- Save article

News

NewsESG roundup: Reputational crises, Ofwat, Swiss Re on Hurricane Sandy

GLOBAL – 'Behavioural' crises have biggest short-term effect on share prices, report shows.

- Save article

Features

FeaturesCyber catastrophe bonds make a debut as insurers offload risk

Cyber catastrophe bonds may be the new kid on the insurance-linked securities (ILS) block, but they have been talked about for years. The jury is out, though, as to whether they will follow the same trajectory as their natural cat bond peers. While some analysts believe they have the potential to go mainstream, others cite concerns over modelling and lack of diversification.

- Save articleNews

Mandate roundup: Leicestershire, Aspect, Macquarie, Swiss Re, Royal London, Mercer

EUROPE – Leicestershire local authority awards hedge fund mandate to Aspect Capital.

- Save articleNews

Zurich and Swiss Re accept pension fund 'say on pay'

[13:00 CET 11-01] SWITZERLAND – Zurich Financial Services and Swiss Re have agreed to submit their remuneration reports to an advisory vote of shareholders at their next annual general meetings (AGM), following pressure from Swiss pension funds.