All Special Report articles – Page 35

-

Special Report

Innovation: What could disrupt ETFs?

Over the last two decades, exchange-traded funds (ETFs) have been one of the most disruptive forces in the asset management industry. But could the tables be turned? In an era of excitement over the possibilities of financial technology (fintech), are ETFs vulnerable to being displaced themselves?

-

Special Report

Focus on Fixed Income: Do fixed income ETFs distort the market?

In this article, which is an excerpt from a recent State Street Global Advisors publication, we address one of the key misconceptions about fixed income (bond) ETFs – namely, that they have become so large that they are distorting the underlying bond market. Instead, we argue, despite their recent growth, fixed income ETFs represent a relatively small proportion of the world’s debt markets.

-

Special Report

ETFs for ESG: Gender equality ETFs gain a foothold

Can a new category of ETFs help address one of the oldest economic imbalances of all?

-

Special Report

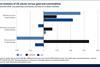

ETFs for ESG: Why passive makes sense for ESG

ESG investing – the incorporation of environmental, social and governance (ESG) factors into investment criteria – has grown rapidly in recent years.

-

Special Report

ETFs for ESG: Sustainable investing is here to stay

Sustainable investing was once viewed as a trade-off between value and ‘values’. Yet today, it’s something investors can no longer afford to ignore.

-

Special Report

Liquidity & Implementation: Woodford fallout renews focus on ETF risks

The recent suspension of redemptions from Neil Woodford’s Equity Income fund is a cautionary tale and one that has further sharpened the spotlight on the liquidity of mutual funds, a category that includes exchange-traded funds (ETFs).

-

Special Report

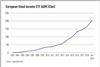

Focus on Fixed Income: The rise and rise of fixed income ETFs

When ETFs first broke up the active management party in the fallout of the financial crisis, it was equity funds that bore the brunt of the impact.

-

Special Report

Focus on Fixed Income: ETFs: the natural home for fixed income

In recent years, fixed income ETFs have been grabbing a larger slice of the ETF market as investors look to capitalise on the enhanced diversification, tradeability, price transparency and liquidity they can provide to bond portfolios. According to the latest research by Citi Business Advisory Services, fixed income ETF assets have increased at a robust 25% annual compound growth rate over the last decade, hitting more than $870bn by the end of 2018.

-

Special Report

Liquidity & Implementation: The shifting sands of index provision

As ETFs are created to track ever more specialised market exposures, competitive pressures and new regulations are impacting the complex relationships between asset managers and index providers.

-

Special Report

Special ReportManagement & outsourcing: The rush is on

Competition is intensifying among providers of data analysis and benchmarking solutions

-

Special Report

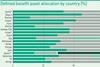

Special ReportChart of the Week: European pension assets exceed €7.7trn

IPE’s Top 1000 Pension Funds survey shows that total assets under management have increased despite market turmoil

-

Special Report

Top 1000 Pension Funds 2019: Asset growth in challenging times

The assets of the 1,000 largest European pension funds increased by 7% to €7.72trn in the last 12 months. This robust increase is set against a volatile backdrop in terms of asset prices and markets

-

-

Special Report

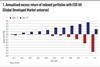

Portfolio strategy – The good things about commodities

Commodities can provide portfolio diversification as well as a cushion against inflation shocks

-

Special Report

France: Act I of the pensions big bang?

The government’s PACTE law could transform the pensions landscape

-

Special Report

Switzerland: Let’s try this again

The Swiss government is to present a social security pension reform bill in the autumn, including some measures rejected by the public in 2017

-

Special Report

Norway: New public sector scheme agreed

A hybrid framework is set to boost competition in the municipal pensions market

-

Special Report

Special ReportCapital markets: All roads lead to China

There are numerous channels through which the Chinese capital markets are opening up to foreign investors

-

Special Report

Austria: Government’s fall is another blow to reform

Promised tax reforms were put on hold following the toppling of the government. But this is just the latest in a line of unfulfilled pension promises

-

Special Report

Special ReportCPPIB’s Asian quest

The largest Canadian pension fund already has a long track-record in the Asia-Pacific region but plans to grow its presence in the region