All Special Report articles – Page 52

-

Special Report

Infrastructure Debt: Why infrastructure is distinct

Andrew Jones, global head of infrastructure debt at AMP, talks about the distinguishing features of infrastructure credit

-

Special Report

Loans in demand

Investors are turning attention to loans as they have become more attractive versus high-yield bonds

-

Special Report

Global trends in institutional ETF trading

As institutions increase their use of ETFs, they have also grown more discerning regarding whom they trade with and how these trades are executed

-

Special Report

Understanding the ETF landscape and flows in Europe

April 2017 marked the 17th anniversary of the listing of the first ETF in Europe. Although no longer a new product, the sector’s growth rate continues to be impressive

-

Special Report

Using ETFs for income investing

Many investors have traditionally associated passive investing with the headline values of indices and the resulting opportunities for capital growth. But over the last decade this approach has changed.

-

Special Report

Indices, ETFs and governance

ESG concerns were once the remit of active and activist investors, but ETF and index providers are becoming increasingly vocal proponents of better corporate stewardship

-

Special Report

Fixed income ETFs: the next frontier

Equity ETFs are still more popular, but fixed income products are catching up

-

Special Report

Investor Strategy: Looking over the hedge

Currency strategy should move up the agenda as global policy divergence continues

-

Special Report

The new silk road

China’s One Belt One Road initiative has the potential to encourage rail improvements and boost trade across Asia and Europe

-

Special Report

Will the pound rebound?

The UK currency could recover from its recent poor performance

-

Special Report

Taxation: Changes ahead

What are the implications of the German Investment Tax Reform Law?

-

Special Report

Alternatives in demand

Universal-Investment’s latest investor statistics show how German institutions have started diversifying within alternatives

-

Special Report

Special ReportGerman Asset Management: A model for collaboration

Asset managers may work with insurers to gain business in Germany’s new defined contribution (DC) market

-

Special Report

Research costs: Managers wrestle with MiFID

Many German asset managers have yet to decide how to apportion external research costs

-

Special Report

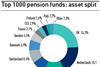

Special ReportTop 1000: A bird’s eye view of €7trn

The assets captured in IPE’s annual study of the leading European retirement asset pools total €7.04trn, up from €6.74 last year – an increase of 4.45%. Yet this growth in assets masks a varied picture

-

Special Report

Austria: Politics distracts from pensions

Pension reforms take second place to political squabbling

-

Special Report

Investment Solutions: No turning back

The way UK pension schemes receive investment advice could change following an investigation by the financial regulator

-

Special Report

Belgium: Cross-pillar reform target

The government has been acting on reform recommendations from the Pension Reform Commission