All Special Report articles – Page 77

-

Special Report

Special Report, The M&A Cycle: The M&A premium

There is no doubt that when M&A picks up, potential acquisition targets attract inflated bids. But Christopher O’Dea finds little evidence of a market-wide M&A premium, and even sectors that are usually targets are seeing prices driven much more by other factors

-

Special Report

Special ReportSpecial Report, The M&A Cycle: Turning the ratchet

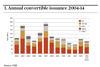

Convertible bonds are not only a good way for fixed-income investors to protect themselves against the ravages of M&A. Martin Steward and Anthony Harrington find that they are a great risk-managed way to exploit the cycle, too

-

Special Report

Special Report – Outlook 2015: Political & Geopolitical Risk

It’s 2014, and geopolitical risk is back. It’s not as if nothing happened since the Berlin Wall came down, but the sudden confluence of a US government shutdown, Russia’s annexation of Crimea, the march of Islamic State and the polling successes of anti-EU parties, not to mention the threatened break-up of the UK, has concentrated minds. Citigroup research confirms there have indeed been more frequent elections and public protests since 2011 than in the preceding decade.

-

Special Report

Special Report – Outlook 2015: A year of eerie calm

While geopolitical activity has picked up markedly, financial market volatility has remained well below long-term averages. Emma Cusworth asks, are investors ignoring a build up of risk, or has the nature of the geopolitical game changed?

-

Special Report

Special Report – Outlook 2015: Giving up freedom for security

Among the many casualties of the financial crisis, perhaps the least heralded but potentially of greatest long-term impact is the modern orthodoxy of central bank independence. Charlotte Moore describes how a new orthodoxy has been written

-

Special Report

Special Report, Fees & Costs: Winds of change

Brendan Maton reports on the anxious vigilance around costs in pension fund management, but finds progress to be frustrated and incomplete.

-

Special Report

Special Report, Fees & Costs: Coming together to cut costs

Caroline Liinanki finds Danish pension providers merging and teaming up to cut investment costs as they reach the limits of what they can achieve themselves.

-

Special Report

Special Report, Fees & Costs: If the price is right

Surveys suggest that investors feel more could be done to make private equity fund terms fairer. But Jennifer Bollen finds that pension funds also recognise that simply squeezing costs may not be the wisest approach.

-

Special Report

Special Report, Fees & Costs: Selling fees short

Hedge fund fees have fallen and managers have come around to the idea of negotiating on them, writes Joseph Mariathasan. But structures still need to be more sophisticated.

-

Special Report

Active Management: Alpha? Bravo!

One of the interviewees who contributed to this month’s special report recalls meeting someone with an unusual business card. Instead of a run-of-the-mill job title – ‘Managing Director’, say – this person styled himself ‘Alpha Generator’.

-

Special Report

Active Management: Feast and famine

The ability to generate alpha might be a skill, but the amount of alpha available from the market is not a constant. Martin Steward asks how we might measure the alpha opportunity and whether investors should vary the risk budget they allocate to active management as a result

-

Special Report

Active Management: False economies?

An influential consultancy tasked with finding savings in the UK’s local government pensions scheme has put forward the idea of pooling its funds into passive investment. Brendan Maton looks at the issues and the sector’s response

-

Special Report

Active Management: The active-versus-active debate

Tracking error has often been used as shorthand for ‘activeness’ in portfolio management. Eric Colson explains the weakness of that approach, and how active share is a much stronger predictor of active performance

-

Special Report

Active Management: Passive skeletons in the active closet

Charlotte Moore tests the limits of quantitative measures of ‘activeness’ in portfolio management, and finds that a good dose of qualitative common sense is a vital part of the manager selection process

-

Special Report

Active Management: Diluting by concentrating

Concentrated portfolios can look like a proxy for high-conviction and high-alpha portfolios. Martin Steward asks if the two things necessarily follow one another

-

Special Report

Active Management: The portfolio tax

C Thomas Howard argues that active equity fund managers are superior stock pickers but destructive portfolio managers, to the extent that stockpicking skill is completely wasted

-

Special Report

Active Management: Understanding investment skill

Rather than outcomes-oriented measures, Michael Ervolini argues that to assess active managers’ skills they need to be isolated by comparing their portfolios with alternative, ‘adjusted’ portfolios

-

Special Report

Active Management: DIY active

Charlotte Moore looks at the smart beta phenomenon and asks, is it really ‘smart beta’, or rather ‘cheap active’?

-

Special Report

Special Report - Emerging Markets: Corporates come of age

A structural advantage is baked into emerging market corporate debt, but exploiting it is dangerous without intense credit work. Caroline Saunders finds a market coming out of childhood but not yet an adult

-

Special Report

Special Report - Emerging Markets: On borrowed time?

Warnings about China’s growing debt exposure abound. Beverly Chandler finds market players confident that the system is robust – but emphasising the importance of continued reform and rebalancing