Investment Strategies – Page 3

-

News

NewsIIGCC launches net zero guidance for private equity

Guidance is intended to support any private equity investors who are active in buyout, growth, and associated strategies

-

News

NewsComPlan to look at UN SDGs in private equity, debt investments

The scheme included physical and transitional climate risks in an ALM analysis for the first time last year

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Fixed income

Last year ushered in a new era for global fixed income and credit markets. It was the worst, in terms of returns, for bond investors in years, but it signalled a regime change. Investors need to be prepared for structurally higher inflation and rates, as well as higher volatility. But for fixed income managers, this is an environment where value is easier to find. Our report looks at this new beginning for fixed income investors, and at how selectivity has become key in the high yield and loan markets.

-

Features

FeaturesResearch: Thematic investing is set to attract fresh capital

In the second article on the new Amundi-Create Research survey, Vincent Mortier and Amin Rajan highlight pension plans’ interest in thematic investing

-

News

NewsSwiss pension fund association lays out ESG reporting standards

Pensionskassen would publilsh qualitative statements on the goals and principles of their sustainability strategies

-

Special Report

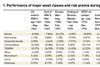

Special ReportProspects 2023: The inflation conundrum facing investors

Institutional investors would do well to include commodities and trend strategies to mitigate inflationary pressures

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Diversification and dislocation in a place called dystopia

What happened to my free lunch? They told me that diversification was there for the taking, yet there has been no zig to my zag. They promised me downside protection, but all I see is red. They said liquidity was a benefit, but never mentioned the bid/ask spread. Welcome to dystopia in the era of dislocation.

-

News

German sustainable finance committee sets priorities for legislative period

Committee lists reporting, financing the economic transformation, and start-ups among its priorities

-

News

Sampension pushes on with inflation-linked bonds, real assets build up

Danish pension fund uses perceived mispricing, systematic rebalancing tactics to add extra returns

-

Special Report

Special ReportFour challenges for asset managers

Leading figures respond to key questions on ● Investment strategy ● ESG

-

News

Pension Protection Fund sets strategic priorities for next three years

The fund is currently conducting a planned review of its funding strategy

-

Country Report

Country ReportInvestment strategy: Asset allocation at a time of uncertainty

Senior investment figures give their views on asset allocation

-

Features

FeaturesBriefing: High yield off to a rough start to the year

High yield did not have a good start to the year. Rising inflation and a more hawkish central bank tone in the US and UK triggered panic selling in January. However, as the dust settles and bad news is priced in, the asset class looks more appealing than other fixed-income segments. Easy pickings may be gone, though, and opportunities will have to be selected carefully.

-

Features

FeaturesBriefing: Now is not the time to give up on emerging markets

“Just when I thought I was out, they pull me back in!” This classic Al Pacino line has applied to many emerging market investors in recent years. Like Michael Corleone, drawn by the potential offered by bold business opportunities, they have accepted to take higher levels of risks in a quest to obtain better results. However, similarly to the family at the heart of The Godfather saga, the outcome of such bets has often caused a lot of pain.

-

Opinion Pieces

Opinion PiecesNo right side to the inflation debate

The question of whether the current trend of rising inflation is a transitory or permanent one is not trivial. It is forcing the institutional investor community to reflect on their long-term investment strategies. Investors have to review their current approaches and get ready to make significant changes if their views prove incorrect.

-

Country Report

Country ReportInvestment strategy: Shifting from fixed income

Swiss pension funds are rebalancing their portfolios but allocating to certain asset classes could prove challenging

-

News

Sampension says low exposure to large growth stocks helped in Q1

Danish pension firm’s CIO says bond portfolio’s make up saved it from worse price falls

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Factor investing report

COVID-19 has added a further blow to a decade of factor investing underperformance and highlighted the increasing impact of environmental, social and governance (ESG) considerations. In this report, we analyse how it may be possible to complement traditional factors with ESG-related measures.

-

Asset Class Reports

Asset Class ReportsTrade Finance: Weathering the storm

Trade and supply-chain finance has faced several threats in recent years but the opportunity for institutional investors is alive and well

-

News

Nordic pension funds keep close eye on inflation trend

The Federal Reserve’s changed inflation goal feeds uncertainty about how and when US policymakers will step in