United States – Page 10

-

News

US SEC proposes asset management ESG disclosure rules

US regulator wants ’consistent and comparable’ disclosures to fight greenwashing

-

News

AkademikerPension to focus on human rights, tax at Meta, Amazon AGMs

Danish pension fund CIO says much more transparency needed in many of Facebook’s business areas

-

News

NewsUS SEC charges AGI and portfolio managers with securities fraud

AllianzGI announces plans to unload US business to Voya

-

Opinion Pieces

Opinion PiecesUS: The SEC’s new climate disclosure rule is a watershed

Most investors, asset managers and consultants look like they are in favour.

-

Opinion Pieces

Opinion PiecesLetter from US: US pension funds decide on Russian holdings

“We support efforts at all levels of government and across the public and private sectors, which include cross-functional and multi-agency partnerships, to divest State Treasury and pension funds from investments in Russian-domiciled companies. We are committed to taking steps that include divesting as soon as possible to have the quickest and most meaningful impact on this tragic situation.”

-

Opinion Pieces

Opinion PiecesLetter from US: ESG faces backlash in some US states over fossil fuels

Is there a backlash against the environmental, social, and governance (ESG) investing movement?

-

Features

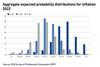

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

News

Sampension to shift climate engagement towards real target-setting

Danish pension fund concludes long-running dialogues with two companies, resulting in ‘noticeable climate progress’

-

Opinion Pieces

Opinion PiecesLetter from US: Liquidity tops the agenda for US pension plans

Monitoring and managing liquidity will be a major issue for many US pension funds in 2022. The risk of a liquidity crunch affects public systems above all, but corporate plans are not immune.

-

Opinion Pieces

Opinion PiecesLetter from US: Crypto currencies gain a toe-hold in America’s 401(k) retirement plans

Crypto investing is not going to become mainstream any time soon in 401(k) plans. But the US retirement market is becoming more and more sophisticated – investors are becoming interested in digital assets, and asset managers, platform providers and consultants are all developing digital products and services.

-

Features

FeaturesBriefing: Insurance-linked securities

Hurricane Ida in late August and early September caused great damage to the southern coast of the US. Fortunately, for people in this area, insurance policies often cover destructions to their properties. Since covering such damage can lead to severe losses for insurance companies, they are keen to reinsure themselves.

-

Opinion Pieces

Opinion PiecesLetter from US: University endowments setting the pace on fossil fuel divestment

US university and college endowments control more than $600bn (€517bn) of investments. Their policies often influence the behaviour of public pensions. So it is interesting to see whether Harvard’s recent decision to end its investments in fossil fuels will be followed not only by other universities but also by retirement systems.

-

News

AP7 hails US class action win as lead plaintiff against China’s Luckin Coffee

Gröttheim calls case clear example of how AP7 holds companies liable for mistakes that hit shareholders

-

Opinion Pieces

Opinion PiecesLetter from US: SEC looks towards mandatory ESG disclosure by companies

October will be an important month for investors and corporations as the Securities and Exchange Commission (SEC) will then propose new rules on climate change and other environmental, social and governance (ESG) issues.

-

News

Pension funds, investors set grand plan to make steel sector decarbonise

‘Business as usual no longer acceptable,’ says Sweden’s AP funds ethics chief

-

News

NewsGrowing foreign assets make Danish pensions an ‘export engine’, says IPD

Statistics show bigger swing to foreign assets for market-rate pensions than for average-rate side

-

Opinion Pieces

Opinion PiecesLetter from US: Hybrid plans in focus

The move from defined benefit (DB) pension plans to defined contribution (DC) has been ongoing for years in the US, both in the private and public sector. But more recently many state and local governments have adopted hybrid designs.

-

News

NewsNorway’s SWF bemoans patchiness of US firms’ climate reporting

NBIM finds stronger climate reporting practices from tech, retail than banking and auto sectors

-

Asset Class Reports

Asset Class ReportsUS Equities: Challenges for US active managers

Active managers are grappling with several key themes as they deal with a concentrated market until recently buoyed by stimulus

-

Opinion Pieces

Opinion PiecesLetter from US: The rise of the new alternatives

Pension funds and other institutional investors used to invest in hedge funds aspiring to outperform public stock and bond benchmarks. Now, after years of disappointing performances, they have changed their attitude. They still invest in hedge funds, but the new expectation is simply to get a few percentage points above the return on zero risk investments.