United States – Page 6

-

News

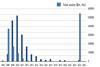

NewsNorwegian oil fund drops $400m of stocks on war-linked grounds

NBIM follows advice from its Council on Ethics, and banishes L3Harris, Adani unit and Weichai Power, divesting nearly $400m

-

Features

FeaturesIPE Quest Expectations Indicator - May 2024

EU parliamentary elections are approaching fast. Current polls predict a shift to the right, with the current centrist parties remaining dominant and the extremist right overtaking the Eurosceptics. US President Donald Trump is still liable to be convicted in a criminal case, but his poll figures are rising.

-

Features

FeaturesUS economy continues to surprise

The resilience of the US economy continues to confound observers. The Federal Reserve’s 11 hikes in interest rates over the course of 2022 and 2023 were implemented to rein in economic strength and to stifle inflation. Scroll forward to the second quarter of 2024 and both inflation and economic activity are still higher than expected.

-

Opinion Pieces

Opinion PiecesUS public pension funds focus on labour practices in private equity

Private equity has become dependent on public pension funds, which represent almost one-third of all investors in the asset class. These schemes invested 13% of their assets – over $620bn (€580bn) in 2022 – up from 3.5% in 2001 and 8.3% in 2011, according to data from public pension research non-profit Equable Institute.

-

Asset Class Reports

Asset Class ReportsFixed income: European high yield stands its ground

Investors flocked to the European junk bond market last year and despite a strong US economy, there is still appetite for European issuers

-

News

NewsAP3 CEO wary of social media manipulation in election year

Staffan Hansén gets up close to US forestry asset while staying aware of 2024’s potential for global political change

-

Features

FeaturesIPE Quest Expectations Indicator - April 2024

The shadow of the US presidential elections is longer than normal because Trump is under several legal clouds. He could still get barred from participating but that seems unlikely. He does have a liquidity problem, a self-destructive streak, a mercurial character and no credible alternative waiting in the wings, though.

-

Opinion Pieces

Opinion PiecesUS pension plans wrestle with China private market exposure

After a horrible 2023, Chinese stocks look cheap and attractive. But most US pension funds do not seem interested in investing in the Chinese stock market. On the contrary, they have reduced their holdings since 2020 and some are exiting entirely, according to Bloomberg analysis.

-

Features

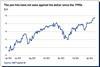

FeaturesReluctance to drop interest rates disappoints the markets

US rates markets entered the year enthusiastically pricing in over 160 basis points of cuts through 2024, and have since had to push back hard on both the timing and magnitude of interest rate cuts now expected by year-end.

-

Asset Class Reports

Asset Class ReportsEmerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?

-

Special Report

Special ReportAGM season preview: nature at the ballot box

Despite the backlash against ESG, biodiversity risks will be on the agenda during the next round of shareholder meetings

-

Features

FeaturesA bumper year for convertible bond issuance

The convertible bond market ended 2023 on a strong note with its main index – the Refinitiv Global Focus – returning 6% in the fourth quarter. The optimism has continued into 2024 on the back of reasonable valuations, historically low equity volatility and better opportunites.

-

Features

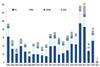

FeaturesContrasting global economic growth fortunes

Economic growth patterns across the world paint a picture of contrasts, ranging from surprisingly robust in the US to soft and struggling in China, with the stagnant euro area narrowly avoiding a technical recession after posting zero GDP growth in the fourth quarter of 2023, following a 0.1% decline the previous quarter.

-

Opinion Pieces

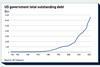

Opinion PiecesUnder the spotlight: US pension plans and their use of leverage

Does US public pension funds’ use of borrowed money and derivatives pose systemic risks to global financial markets? That is the concern of global regulators, which have recently stepped up scrutiny of the practice, according to a recent article in the Financial Times (FT). But senior executives interviewed by IPE seem less worried.

-

News

NewsFollow This, Arjuna Capital ask court to throw out Exxon’s lawsuit against them

Shareholders argue there is no subject matter jurisdiction for oil and gas major’s compliant to proceed

-

Features

FeaturesIPE Quest Expectations Indicator - February 2024

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Opinion Pieces

Opinion PiecesGuaranteed retirement income and AI: key themes for the US in 2024

The three major 2024 trends in the US retirement industry, according to senior industry figures interviewed by IPE, are: Plan sponsors will continue to expand financial wellness programmes and explore optional provisions of the new pension law SECURE 2.0. Plan participants will up their demand for guaranteed income and ...

-

News

NewsInvestors bemoan ExxonMobil legal move against shareholder climate resolution

Oil and gas major says it turned to court in bid to ‘stop abuse’ of shareholder proposal process

-

News

NewsNorway’s SWF builds up stewardship team in New York

With North American assets making up nearly half the €1.4trn SWF’s equity fortune, gaining more first-hand experience in the region is key for GPFG, says governance chief

-

News

NewsUS GAAP stumbling block for Dutch DC switch

Several pension funds told regulator DNB the matter prevents them from making the transition to DC