United States – Page 8

-

![RobertGEcclesPhoto[1]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/8/2/3/142823_robertgecclesphoto1_404467_crop.jpg) Opinion Pieces

Opinion PiecesESG remains mired in politics in the US

“I am not going to use the word ESG because it’s been misused by the far left and the far right,” said BlackRock CEO Larry Fink in a conversation at the Aspen Ideas Festival in June.

-

Opinion Pieces

Opinion PiecesLetter from US: Annuities move into the US market

Three of the largest players in the US pension industry are launching new products that offer annuities as a retirement savings distribution option. Millions of Americans will soon have access to pension-like investments in their 401(k) plans thanks to BlackRock, Fidelity Investments, and State Street Global Advisors. The other large player in the US market, Vanguard, will not take part in this new trend.

-

Features

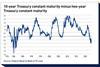

FeaturesFixed income, rates & currency: US debt crisis averted – what next?

The US debt ceiling crisis was resolved in June, avoiding potentially major fireworks, with a suspension of the limit until early 2025. This ensures that the next time the politicians have to fight about it will be after the November 2024 presidential election. Although markets were relieved at the temporary resolution, the process of rebuilding the very depleted Treasury cash balances – with some huge bill auctions planned – will drain significant liquidity from the system, which could put pressure on the rates market.

-

Features

FeaturesDiscerning investor sentiment: this year’s proxy season

Every annual general meeting (AGM) season has traditionally brought with it a few symbolic moments – events that serve as broader indicators of the market’s mood when it comes to environmental and social issues.

-

Special Report

Special ReportOutlook – Europe and the world: UK launches its own approach to green investment

The focus is on financial regulation rather than economic policy to drive decarbonisation

-

Features

FeaturesBlackRock executive pegs inequality with new opportunity index

“Inequality is both a risk and an opportunity that should be measured,” says Gavin Lewis in a conversation about his book ‘The Opportunity Index: A solution-based framework to dismantle the racial wealth gap’. Growing up in a single parent household without a father in Tottenham, a predominantly black area of London with high poverty levels, Lewis is well qualified to have a view on inequality. But as a managing director at BlackRock, is he also an example of the exception that proves the rule?

-

Special Report

Special ReportOutlook – Europe and the world: US overtakes Europe in clean-energy production

Incentives package for US-based clean energy investments is seen by some as a threat to Europe’s industrial competitiveness

-

Asset Class Reports

Asset Class ReportsEquities – Does location matter in the corporate listings debate?

The number of listed companies have fallen dramatically, but London remains a preferred global financial centre

-

Opinion Pieces

Opinion PiecesUS: state enrolment systems gain traction

There are signs that the US state-facilitated retirement savings plans are starting to have a positive impact on both the creation and uptake of private pension plans.

-

Special Report

Special ReportSpecial Report – Outlook: Europe and the world

Inflation may be losing momentum, thanks to vigorous central bank action, but with a recession on the horizon, it is hard to tell whether the next few months and years will see markets turn around and risk assets begin to perform again. For the time being, CIOs argue for selectivity in stock selection and generally agree that bonds have resumed their diversification role. The main article in our Outlook report features the views of influential CIOs and strategists on asset allocation for the next few years.

-

Opinion Pieces

Opinion PiecesUS: Politics drive ESG debate

Three Republican candidates for the White House are vocal advocates against pension funds adopting environmental, social and governance (ESG) investment practices.

-

News

NewsIlmarinen anchors biggest ETF launch yet

Finnish pensions giant prompts creation of tracker fund based on new MSCI climate index – switching €1.86bn into new ETF

-

News

NewsAlecta fires equities chief; hires acting CIO as Billing slashes foreign holdings

Sweden’s largest pensions institution makes rapid changes to shore up public confidence after US bank losses

-

News

NewsBank demises isolated, but VER’s CEO warns of wider crisis if rates stay high

Timo Löyttyniemi says collapse of SVB and forced sale of Credit Suisse only indicate problems with certain individual banks

-

Opinion Pieces

Opinion PiecesUS: Private equity losses weigh on pension funds

US public pension funds should brace for a big negative surprise when they prepare their reports for the fiscal year ending 30 June 2023. Only then will their returns reflect losses from 2022 in their private equity (PE) portfolios.

-

News

NewsSweden’s AP funds gather pension majors to coax tech giants on human rights

AP Funds’ Council on Ethics convenes institutional investor group including Railpen, APG, PGGM and USS for joint engagement with Alphabet, Meta and others

-

News

NewsAlecta’s board orders immediate strategy probe after US bank losses

Swedish occupational pensions giant says its First Republic Bank investment risks being completely lost too

-

News

NewsSwedish watchdog grills Alecta, others as US bank losses pile up

NBIM ‘closely monitoring the situation in the market’ after €281m exposure to collapsed banks

-

News

NewsAlecta says it’s solid despite losing €1.3bn on US banks in days

Silicon Valley Bank, Signature Bank collapses erase 1% of Swedish pensions giant’s portfolio

-

Features

FeaturesUS: SECURE 2.0 means the hard work ahead for pension plan sponsors

On one thing pretty much everyone agrees: the new SECURE 2.0 Act is very broad, complex, and will create a lot of work for US plan sponsors and retirement providers. In fact, the Setting Every Community Up for Retirement Enhancement law includes over 90 different provisions.