The increase of the minimum interest rate – Mindestzinssatz – on pension savings to 1.25% recommend by the Swiss federal commission for occupational pensions, BVG-Kommission, is a challenge for pension funds, but sustainable, according to the commission’s president Christine Egerszegi-Obrist.

“We held 1% [minimum interest rate] for years. A year ago we had negative interest rates and pension funds suffered considerably, [but] the interest rate landscape has changed, [therefore] we have carefully increased the interest rate,” she told IPE, explaining the decision taken by the commission.

The minimum interest rate is paid on pension assets in the mandatory part of the occupational pensions insurance, for members earning at least CHF22,050 in 2023.

The majority of the members of the BVG-Kommission has taken into account a significant rise in interest rates as a result of increasing inflation to vote in favour of a 0.25 points increase next year, the commission said in a statement.

“The development in terms of wages was clear, upwards, and we [also] wanted to make a statement that 1% is flexible, if there are changes. It is a minimum rate so pension funds can apply a higher rate if they want,” she added.

Egerszegi-Obrist believes the Federal Council will accept the recommendation in October.

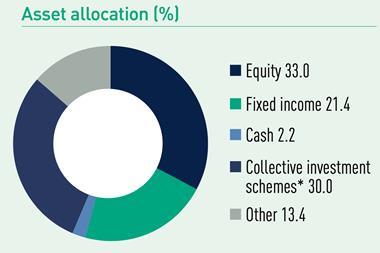

Returns on bonds, equities, and real estate, are also crucial to determine the level of the minimum interest ratte.

Last year, Swiss pension funds recorded losses, but this return averaged in the first half 4.6%, with all asset classes performing well this year, according to a recent report by the occupational pension supervisory commission OAK BV.

Despite negative returns, last year the average interest rate was 1.71%, well above the minimum 1%, thanks to reserves accumulated in the past by pension funds to fend off capital markets volatility, according to a report published by consultancy PPCMetrics.

Social partners call for higher rate

The Swiss Federation of Trade Unions, SGB USS, is asking the Federal Council to set the minimum interest rate at 2% for 2024. The 1.25% rate recommended by the occupational pension commission is behind the current level of inflation, the union said in a statement.

Inflation in Switzerland stood at 1.6% in August this year, compared with the same month of the previous year, according to the Federal Statistical Office (FSO).

The result of BVG-Kommission’s decision is that second pillar members’ pension assets continue to lose value and the change in interest rates does not reach those employed, although they have already paid a high price during the negative interest rate phase, the union added.

Union Travail.Suisse welcomed commission’s decision, which takes the interest rate turnaround into account, but hoped for a bigger increase as the long phase of negative interest rates is “behind us”, and returns on financial markets are higher this year, it said in a statement,

The Swiss Employers’ Association favours instead a reduction of the minimum interest rate to under 1%.

Financing occupational pension benefits remains a challenge for pension funds this year, as political and economic developments weight on financial markets, it said.

The latest digital edition of IPE’s magazine is now available