The Pensions Regulator (TPR) in the UK will not be telling schemes how to invest, chief executive officer Nausicaa Delfas told the industry during the Mansion House Pensions Summit yesterday.

Delfas said the regulator is supportive of any attempt to help trustees consider alternative asset classes in “search for value and diversification”. However, she said that as a regulator, TPR will not be mandating how schemes should invest, and will leave that decision to trustees.

Instead of mandating, Delfas said TPR will be challenging decision-making to “make sure trustees are always acting in members’ interests”.

She said: “That means trustees understanding the balance between risk and reward.”

Delfas said that taking too much risk puts savers’ pension pots in “jeopardy” but at the same time, over-investing in low-risk, low return assets could also end up “depriving them of much needed retirement income”.

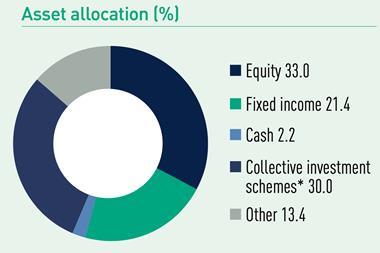

“The key is achieving the right balance through investing in a properly diversified portfolio,” she noted.

In both defined benefit (DB) and defined contribution (DC) schemes, trustees have a duty to act in savers’ best interests, she stressed, explaining that it meant working hard to deliver the retirement income that savers expect, including properly considering the full range of investment options.

In July, Jeremy Hunt, the UK’s chancellor of the exchequer, announced plans to unlock up to £75bn of additional investment from DC and Local Government Pension Schemes (LGPS) to help grow the UK economy and deliver benefits to savers.

As part of this move he announced a Mansion House Compact which saw nine pension funds commit to allocating at least 5% of their default funds to unlisted equities by 2030. Currently, the UK’s DC schemes investment in UK unlisted equities is under 1%.

Delfas said: “The Compact is a voluntary agreement brought forward by firms searching for greater value for savers.”

She added that while TPR would not advocate for investment in one asset class over another, the regulator is supportive of innovation which is in savers’ interests and initiatives which call on trustees to consider well thought out diversified investment strategies.

She continued: “Private market investments of course can have a part to play in a diversified portfolio and new ways to access these opportunities are becoming available to trustees, such as long-term asset funds.”

For this reason, Delfas said, TPR will provide new guidance by the end of the year on investing in private markets and will be in “due course” updating its existing investment guidance for DB and DC schemes.

The new DB Funding Code is also expected to clarify that there are “no limitations” on what constitutes suitable assets in which to invest, and all schemes can invest in growth assets, with much greater flexibility for open schemes and those further away from their end game, Delfas said.

Read the digital edition of IPE’s latest magazine